FBX Index April 2025: Container freight volatility rises amid trade disruptions

● Traditional trade routes, particularly the Asia to Europe route, are experiencing more frequent disruptions.

● The container trade is projected to grow around 3.6% each year through 2028.

The container freight market is undergoing significant changes that could have major implications for global trade flows.

The latest UNCTAD report estimated that global trade saw a record expansion to $33 trillion in 2024, an increase of 3.7% from 2023. Volatility is rising on the back of the ongoing conflict in the Middle East, which is bringing risk management strategies around hedging costs to the fore.

Rising risks in an uncertain market

The container market is an integral part of the overall shipping market, with more than 90% of global goods shipped by sea. Of this, around 60% is transported in containers. The potential shifts in global trade are causing uncertainty in the container markets, and in many cases, key shipments are being rerouted to other destinations where possible. These developments are raising questions around the cost of shipping, with the main trade lane from production centres in Asia to destinations such as the United States or Europe being some of the most impacted due to the sheer volume of goods transported on these routes.

The softening of spot market rates continues to challenge the long-held belief that longer fixed-term contracts are beneficial to the market. Declining spot rates edging toward the level of the longer-term fixed prices are prompting some major liners and freight forwarders to reconsider rates that are more closely tied to the spot markets, and indices such as the Freightos Baltic Index (FBX) represent a good reference price for this trade.

The softening of spot market rates continues to challenge the long-held belief that longer fixed-term contracts are beneficial to the market. Declining spot rates edging toward the level of the longer-term fixed prices are prompting some major liners and freight forwarders to reconsider rates that are more closely tied to the spot markets, and indices such as the Freightos Baltic Index (FBX) represent a good reference price for this trade.

With the continued uncertainty regarding the cost of freight, more companies – from the liners to the freight forwarders and the cargo owners – are evaluating their trading strategies. Managing the cost of freight typically brings some degree of price certainty to global supply chains. Companies are looking at what they hedge, which could contribute to the continued development of the financial markets in container freight at exchanges like CME Group.

Volatility and disruptions continue

FBX indices remain volatile across many of the trade routes. The North Asia to Europe and North Asia to the US West Coast routes are two of the most volatile amid the policy shifts, which include disruptions in the South China Sea and rerouting away from the Suez Canal on the back of more frequent attacks on shipping off Yemen.

The latest UNCTAD report shows that there was a total of 23 million teu traded in 2024 between Asia and Europe, which highlights the important role that the Suez Canal plays in maritime trade.

Disruptions to the traditional trade routes, most notably in the Asia to Europe route, have also become more frequent. It is important to note that the ongoing conflict in the Middle East has contributed to a greater disruption to freight entering into and exiting from the Suez Canal, which has forced owners to take much longer diversions to arrive in Europe. Businesses that rely on imports or exports to global markets have had to plan much further ahead, or in some cases, divert goods to other markets. This has all been a contributing factor to the overall volatility in the freight price.

Growth outlook in containers appears robust

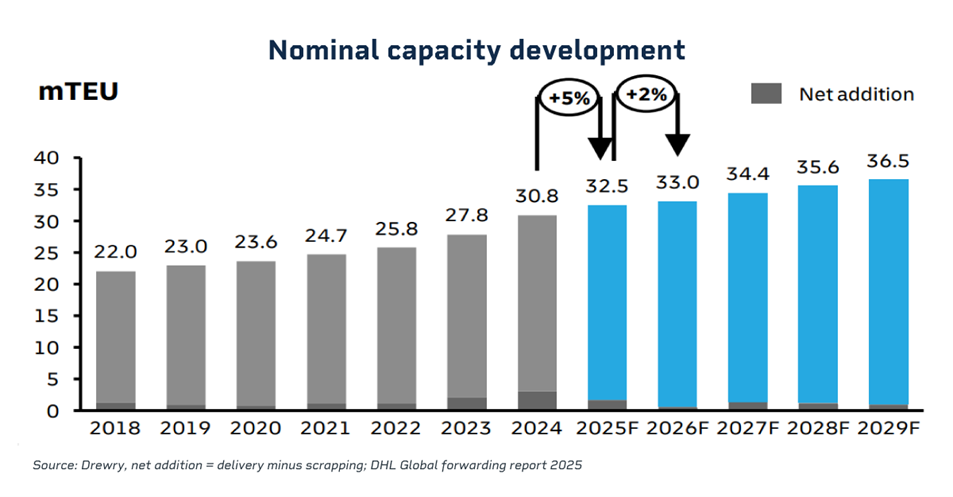

The latest report from UNCTAD shows that there were 59.36 million TEUs shipped on the main East-West routes in 2024, a rise of around 5% from 2023. The DHL Global Forwarding report for 2025 shows that on a longer-term basis, the container trade is expected to grow 3.6% on average from 2024 to 2028. In volume terms, this would mean adding a further 6.1 million TEU of capacity per year.

Hedging the container cost as prices fluctuate

With the potential for growth in the market and ongoing uncertainty, hedging instruments like CME Group’s container freight futures can be used in a number of ways as companies in the supply chain look to manage price risks.

With the potential for growth in the market and ongoing uncertainty, hedging instruments like CME Group’s container freight futures can be used in a number of ways as companies in the supply chain look to manage price risks. For example, a freight forwarder may choose to negotiate a fixed-price contract with a liner for a number of containers per month and then offer a cargo owner a floating price or index-linked deal. Alternatively, a freight forwarder may choose to offer a cargo owner a fixed price for a number of containers and negotiate a floating price or index-related deal with a liner. The reason why one trade structure may be more beneficial over another depends on the view that the market has over potential price direction.

For example, if a freight forwarder negotiated 400 containers on 1 June for September 2025 at a price of $4,200 per container, then the total cost to the freight forwarder is $1.68 million. In turn, they offer out the containers to a cargo owner on an index related basis using the FBX index to provide an element of flexibility into their pricing structure. Both the freight forwarder and the cargo owner have the opportunity to hedge against a price change in the underlying index price. In the case of the freight forwarder, they hold a long position in the physical market and, in order to be fully hedged, would sell 400 lots of futures and assume a short position in the futures market. However, for the cargo owner, they hold a short position in the physical market and, to be fully hedged, they would buy 400 lots of futures and assume a long position in the futures market.

In this example, the freight forwarder is expecting the market price to weaken, and if it does, then they can buy back their 400 lots of futures they sold to close out their futures position. However, for the cargo owner, they expect prices to rise, and if they do, they can sell their 400 lot of futures they bought to close out their futures position.

The volatility in the container freight market looks set to continue, considering the number of geopolitical events that are disrupting supply chains of key goods. Freight routes are being diverted, cargoes are taking longer to be delivered, and all of these factors are contributing to heightened levels of volatility. As companies along the supply chain look to hedge price risk in the market, the container freight market could see a higher level of activity in the months ahead.

About Paul Wightman, Senior Director, Research and Product Development, CME Group

Paul is a subject matter expert in commodities. He leads the research efforts to design and develop new product opportunities related to the exchange traded and over the counter markets. Paul has also undertaken numerous external speaking engagements around the commodity markets. Paul is regularly involved in the strategic decision-making processes around the launch of various new initiatives, including the development of new product ideas in conjunction with a growing list of channel partners. He is also responsible for the marketing content across our various commodity markets to bring awareness of our products and identify some of the market trends that are occurring.

Receive monthly container market reports direct to your inbox.